The annual reports of the International Organisation of Vine and Wine on the state of the global wine market are an invaluable resource for understanding the current state and trends of the world’s wine market. As we await the full OIV report for 2023, we have revisited previous reports and summarised the data for your convenience. Much of the data from previous years remains relevant, helping you to identify the most attractive countries for wine imports.

Global Wine Demand

In 2022, global wine demand amounted to approximately 232 mhl, 1% lower than in 2021. The trend of declining wine demand has continued since 2017, largely due to a steady decrease in demand from China by 2 mhl per year. The Covid-19 Pandemic in 2020 also played a significant role, with its quarantine measures and disruption to logistics chains.

The War in Ukraine and the energy crisis of 2022 created inflationary pressure on prices, resulting in a 15% increase in wine prices compared to 2021. Total wine exports in terms of monetary value reached a record high of 37.6 billion euros, 9% higher than in 2021.

Wine Demand in Volume in 2022

The European Union remained the primary consumer of wine in 2022, accounting for 48% of total global wine consumption (111 mhl of wine). The United States ranked second with a stable wine demand over the past few years at 34 mhl, or 15% of global wine consumption. China accounted for only 4% or 8.8 mhl; just a few years ago, in 2018, this figure was twice as high at 17.6 mhl.

Among the top three wine markets in the European Union are France at 25.3 mhl, 11%; Italy at 23.0 mhl, 10%; and Germany at 19.4 mhl, 8%. These three countries represent 29% of EU wine consumption. Next come Spain (10.3 mhl, 4%) and Portugal (6 mhl, 3%), ranking 4th and 5th in terms of demand in the EU.

Indicators for the European Union have remained relatively stable, though it’s worth noting a noticeable decrease in consumption in Italy by 5% and an increase in demand in Portugal by 16%. Not to be overlooked are the Netherlands (3.6 mhl, 2%) and Romania (3.7 mhl, 2%), as both have shown stable wine consumption figures over the past 5 years.

The United Kingdom also remained an important wine market. The UK accounts for 6% of global wine demand, making it the 5th largest wine market in the world. Following the UK is Russia, with a 5% share.

High demand for wine in countries like France or Italy is mainly met by domestic wine producers. As such, there is high competition in these markets. These difficulties are not insurmountable, however, as it’s worth considering that a larger market provides more opportunities for wine imports from other countries, with a more developed market and distribution channels.

For a better understanding of the attractiveness of a particular market, it is also key to look at wine export and import volumes.

Wine Export Volumes Worldwide

In 2022, the total global volume of wine exported amounted to 107 mhl: 5% lower than the record-breaking year of 2021. In terms of monetary value, wine export volume reached 37.6 billion euros, 9% higher than in 2021. More than half of the world’s wine exports in 2022 (both in monetary and volume terms) were accounted for by France, Italy, and Spain (a total of 57 mhl and 23.1 billion euros).

France remains the undisputed global leader in wine export by value, with an industry of 12.3 billion euros (a 10% increase compared to 2021). By volume, France exported 14.0 mhl, which was 5% lower than the previous year. Italy and Spain exported almost the same amount of wine as in 2022, with volumes of 21.9 mhl and 21.2 mhl respectively. Italy’s wine export value was twice as valuable, however, at 7.8 billion euros, while Spain’s accounted for 3.0 billion euros.

In terms of volume, other significant exporters in the international wine trade include Chile and Australia (8.3 and 6.4 mhl respectively), followed by South Africa, Germany, Portugal, the United States, New Zealand, and Argentina.

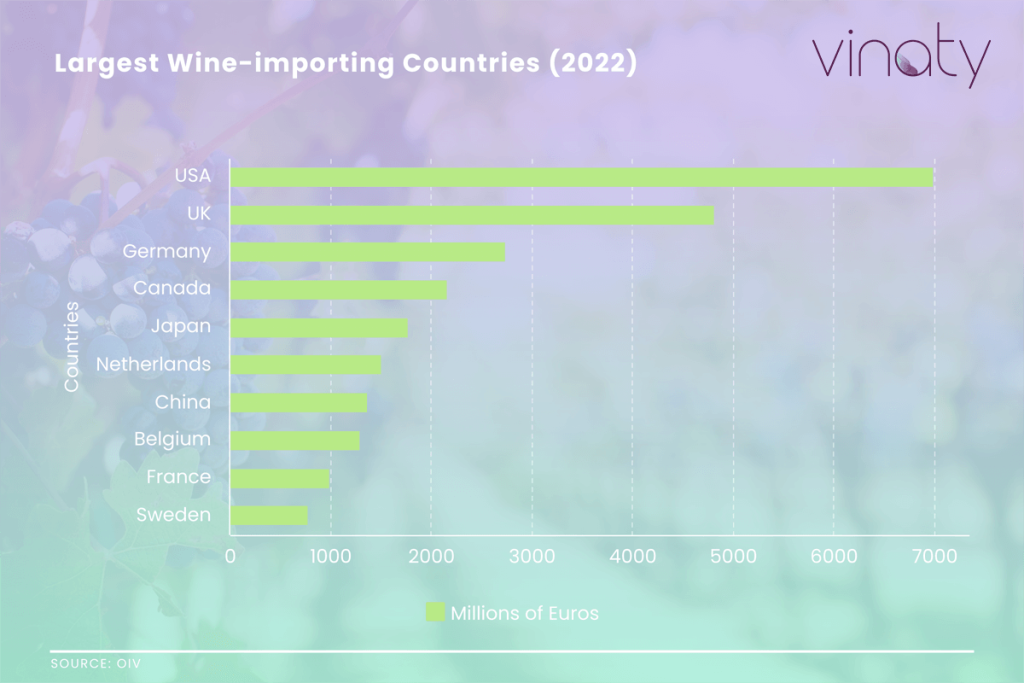

Largest Wine-importing Countries

The largest importer of wine in the world in 2022 was the United States, whose 14.4 mhl of imports accounted for 7 billion euros. The volume of wine imports into the country increased by 3%, and, in terms of monetary value, the increase was 17%. Germany ranked second among wine-importing countries at 13.4 mhl or 2.7 billion euros, followed by the United Kingdom in third place on 13.0 mhl or 4.8 billion euros.

Based on the above data, countries with a developed wine market, high demand, and relatively low domestic wine production may be of greatest interest. Among these countries, the Netherlands stands out, importing 4.6 mhl of wine in 2022, worth 1.5 billion euros, making it the fourth-largest importer in the world. Belgium demonstrated similar indicators with 3.3 mhl imported in volume worth 1.3 billion euros. Also noteworthy in Northern Europe is Sweden, which imported 2.1 mhl in volume and 778 million euros worth of wine.

Outside of the EU, important wine importers include Canada, Russia, Japan, and China. Canada for example imported 4.2 mhl of wine, worth 2.2 billion euros, while China imported 3.4 mhl, worth 1.4 billion euros. Japan increased its wine imports in 2022 both in volume (2.7 mhl, a 9% increase on 2021) and in value (1.8 billion euros, with 39% of wine imports being sparkling wines).

Types of exported wine

In imported wine, 53% of trade consisted of bottled wine with a volume of up to 2 litres. In terms of value, this category accounted for 68% of all international wine trade. The average price was 4.5 EUR per litre.

Bag-in-Box (BiB) wine accounted for only 4% in volume and 2% in value of the total world exports. BiB wines typically range from 2 to 10 litres in packaging.

Bulk wine, which includes wines packaged in containers larger than 10 litres, accounted for 32% by volume and 7% by value of total world wine exports.

Sources:

https://www.oiv.int/sites/default/files/documents/2023-04_Press_Conf.pdf

https://www.oiv.int/sites/default/files/documents/OIV_World_Wine_Production_Outlook_2023_2.pdf