In 2023, we are faced with both a decrease in wine production in the Southern Hemisphere and a decrease in the international demand for wine. This resulted in a 6.3% decrease in the global wine export volume, which fell to 99.3 million hL, the lowest figure since 2010. At the same time, the global wine export value in 2023 reached 36 billion EUR, the second highest ever recorded. This was also reflected in export prices, which increased significantly to 3.62 EUR/l, a 2% increase on 2022.

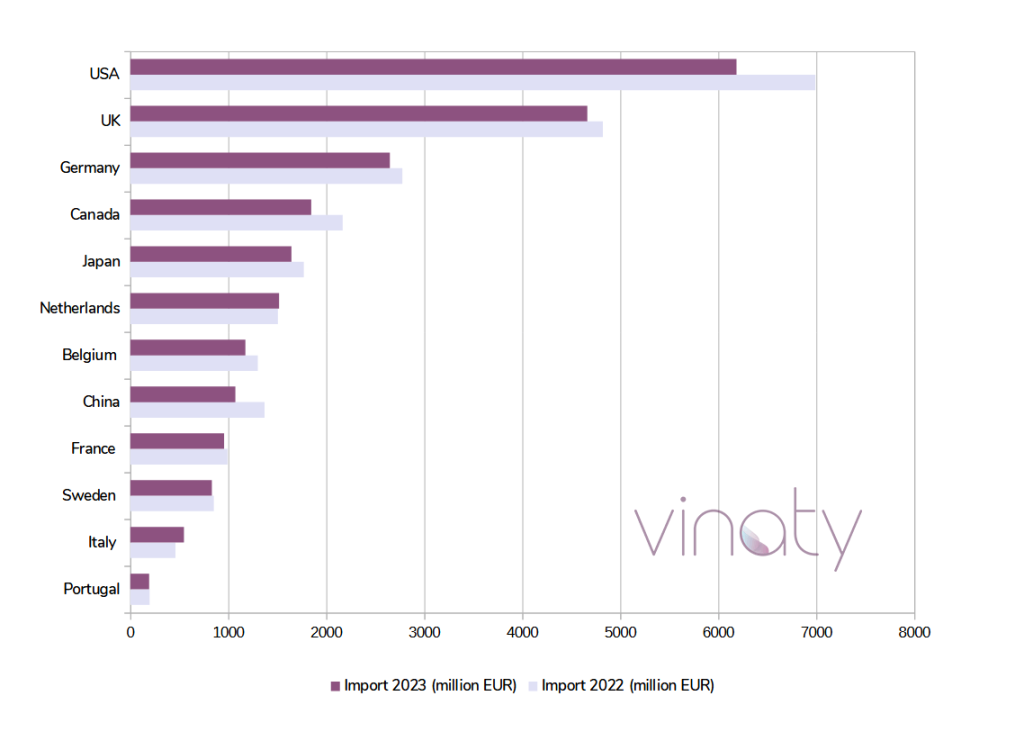

Germany, the UK, and the USA remained the largest wine import markets in 2023, but the US experienced a significant decline in imports. These three countries hold a global market share of 37% in terms of value.

Now we’ll come the value of wine imports. The United States may have lost its position as the largest wine importer in terms of volume, but it keeps first place in wine imports in terms of value. That import value reached 6.2bn EUR, a decrease of 11.5% on 2022. Imports of sparkling wine fell especially sharply, by some 17%.

In the UK, the second largest import market, 4.7bn EUR was imported: 3.3% less than in 2022. In 2023, Germany became the third largest importer of wine in the world, with a total import volume of 2.6bn EUR, 4.6% less than the previous year. This decrease was principally due to the import value of bottled wine, which accounts for 62% of the total value of German wine imports.

Reflecting the trends of its neighbours in the USA, Canada’s imports reduced by 14.8%, a figure worth 1.8bn EUR. Wine imports to Japan decreased by 7.1%, worth 1.6bn EUR. On the other hand, one of the largest EU wine markets, the Netherlands, showed stable figures, increasing by 0.8% on 2022, to some 1.5bn EUR.

China showed the most significant drop in imports, with wine imports valuing some 1.1bn EUR, 21.7% less than in 2022.

Source: OIV Report 2024